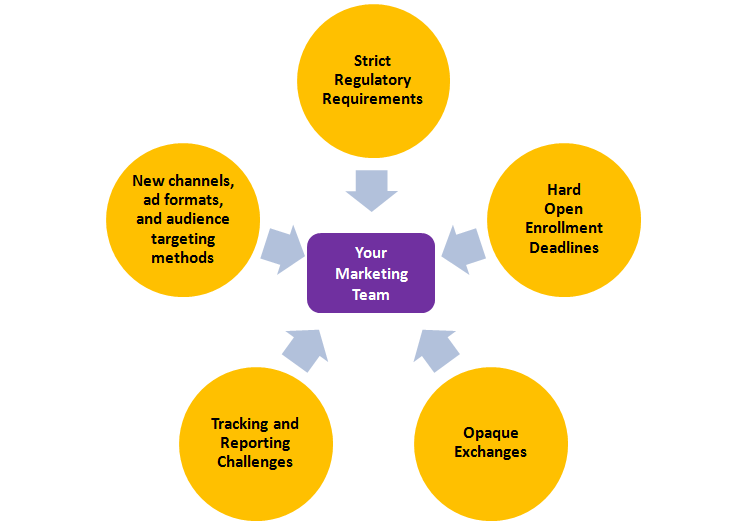

Health insurance, a highly regulated space with large players, tends to be a “late majority” market in terms of adopting new technologies (as opposed to “early adopters”). Having to partner with an exchange where tracking data is limited, the pressure of open deadlines, new creative formats, hard deadlines, and the always watchful eye of the regulators make for a lot of pressure on a health insurance marketing team. To top it off, online marketing, with its rapid pace of change, is always a little ahead of where insurers and regulators may be comfortable operating.

Figure 1 – Pressures on Health Insurance Marketing Teams

In this article we’re going to explore these challenges any health insurance marketing team will have to contend with, and also the advertising platforms themselves, open enrollment budget flighting, member retention, and navigating health insurance company corporate culture.

New Channels, Ad Formats, and Audience Targeting Methods

Shifting to mix-and-match creatives such as responsive search ads and responsive display ads a few years ago is one example of a disruptive change to the way health insurance has been marketed; other examples of new advertising approaches that insurers were slow to adopt (and some still haven’t) include native advertising, Google Discovery (think of that as Google Native Advertising on Google-only platforms such as YouTube, Gmail, and the Android news feed), and TikTok advertising.

When shifting to a new platform or a new way of advertising, often there are benefits to the early adopters. Facebook Ads, in the early days, was an incredibly profitable channel to make money for a few years…until everybody jumped into the pool and bid up the cost-per-click. Similarly, by adopting newer marketing channels or methods, insurers can get a leg up on the competition, increasing their reach and reducing their cost-per-member.

The key to running a high-performance health insurance marketing program with a large digital component is, preserving audience targeting strategies and messaging that has worked in the past, in combination with testing and later more widely deploying new marketing channels and ad formats with messaging that speaks to prospects evolving needs.

Hard Open Enrollment Deadlines

As you likely already know (we’ll say it here for those who don’t), Individual and Family and Medicare typically have an “open enrollment” date, when it is legal to market your plans to consumers, somewhere between around Oct 1 – Dec 7. Other types of plans such those for K-12 educators, State & Local Government and Higher Education), and FEHB (federal employees and military contractors) have similar but shorter timeframes, usually starting a few weeks or a month later, depending.

Also, there are other programs (SEP, or “Special Enrollment Period”) you can run outside of open enrollment, for instance, people who have had a life change of some type or have moved into an area, or have lost their job and healthcare coverage, not to mention simply running Brand ads as well all year.

Because all of the open “enrollment” marketing programs will launch either all at once, near each other, or at least somewhat on top of each other, developing campaigns for multiple markets can really be challenging for a single marketing team – especially with Medicare which has much stricter regulatory compliance requirements.

As such, the earlier you can start developing your strategy, campaign messaging, and audience targeting, the better. A rule of thumb: if you’re starting to draft creative messaging in early July you’re probably going to be OK…if you start on September 1 instead after everyone is back from vacation, it’s going to be a very difficult and crazy few months for your team.

Strict Regulatory, and Platform Requirements

CMS, the regulatory body that controls what happens in the health insurance industry, has very strict advertising guidelines that must be adhered to. These guidelines are no joke, and not complying with them is a career-limiting move and could expose the company to numerous liabilities.

Additionally, the advertising platforms themselves – Google Ads, Facebook Ads, LinkedIn, Snapchat, TikTok, etc) all have their own guidelines and ad formats that advertisers must adhere to.

The process of creative development itself in the health insurance industry can be a challenge as a result. When you’re trying to get 30 or 40-character headlines approved by compliance/legal… and they keep coming back with suggestions that explode the size to 43 or 50 characters, leading to multiple rounds of review and changes….it can be very frustrating for a marketing team.

The ad platforms themselves have strict policies; Google for instance often auto-rejects search ads that have the remotest reference to “drug” or “pharma” phrases, so referencing that great drug coverage that is differentiating you this year could end up sinking your ads during the first few precious days of open enrollment.

This is why it’s essential that your agency, or whoever is drafting the creatives, has a thorough understanding of the health insurance market, the advertising platforms, and regulatory requirements.

CMS 5 Star Ratings, Customer Satisfaction, and “Social Determinants of Health”

Let’s talk for a minute here about not price, place, or promotion, but the product itself. Health insurance plans are rated in each state by CMS every year, and if one of your plans is “CMS 5 Star Rated” then you can message that – and in any market, saying “5 Star Rated” is a great way to get clickthrough rates up on ads – and also there are benefits in terms of offering a longer post-open enrollment period of enrollment – when you can still market your plans to prospects.

Health insurance marketers highly covet that rating, and one highly-weighted component of the rating is customer satisfaction. Interestingly, companies like Healthrageous are addressing this in that food security and better medical outcomes that come with it drive higher customer satisfaction ratings, by providing home delivery of frozen meals, covered in some circumstances by Medicare.

So coverage of Medicare home delivery of frozen meals (for a few weeks for instance, after surgery) is an increasingly popular plan element being adopted by various insurance providers, to try to increase their CMS rating and out-market their competition.

Interestingly, this area falls conceptually under the area of “social determinants of health”, which is driving a number of trends in the healthcare industry, not just health insurance, and bears watching.

Make Sure to Buy Some Leads – Both for Value but Also as a Benchmark

There are numerous lead-generation companies whose campaigns spring up during open enrollment who will bid on your search brand terms and the brand terms of others, as well as early funnel terms. As with any industry, you really should make an effort to buy leads from at least two vendors, at least on a limited basis – somewhat for the leads themselves, but also in order to gauge the effectiveness of your own campaigns – it can act as an independent source of cost/conversion and cost/member data for you. So, even though you may see these ads every year and are fuming with indignation that someone is bidding on your brand name besides yourself…pinch your nose and go ahead and contact the vendor and get some pricing from them.

Allocate Some Budget to Member Retention Campaigns During Open Enrollment

While cost/new member is a key KPI for any health insurance marketing program, retaining members is even more important since your population of existing members is always likely to be larger than each year’s set of new members.

Bidding on terms where someone wants to compare you to your competitors (i.e. “blue cross vs cigna” type terms, negative customer-service terms like “blue cross problem”, and terms like “cheaper than blue cross”) are one good way to head possible defecting members off at the pass and present them with some specific messaging tailored to them.

Opaque Exchanges (and “Faith-Based Marketing”)

For some health insurance marketing programs, you are required to send your traffic to your page on a government health care exchange. These exchanges are either at a national or state level and conversion tracking is really dependent on what kind of reporting you will be able to get back from the exchange later. These are huge government bureaucracies; the likelihood of letting you drop a Google Tag Manager tag on a page for tracking purposes is near-zero.

In such cases, the program is best measured by reach, impressions, clickthrough rate, CPC (for display only), and ultimately – very high-level results.

At the end of the day, as a direct-response or “performance” marketer, the idea of measuring multiple campaigns across multiple channels by one number (member signups), may feel anathema; but it’s often the reality in the healthcare insurance industry and you just need to accept it – measure what you can and when in doubt, do the right thing for the company – even if it can’t be measured.

This is what we call “faith-based marketing”, and it’s not a bad thing – it’s just reality sometimes.

Open Enrollment Flighting

Over numerous health insurance campaigns we have run for several different organizations, we’ve seen the same pattern – after Thanksgiving when marketers return from spending time with their families, CPCs start rising, then the final seven days CPCs go through the roof and start resembling gambling industry CPCs.

Our philosophy is it makes more sense to do the early-funnel activities earlier in the season – surrounding prospects with impressions on as many platforms as possible – to get into their minds when they enter the research and consideration phases.

There are procrastinators who sign up late – true – but those are best addressed in our viewpoint via your search budget.

So for flighting, consider spending the bulk of your display budget in the early part of open enrollment..then at the end of the season ramp up that search spend (and bids, or you’ll never get the clicks you need to close those procrastinators).

Tracking & Reporting Challenges

Timely reporting with sufficient granularity is a must for running large-budget health insurance campaigns; management is interested not only in driving results but seeing evidence of industry and good stewardship displayed along the way.

Budget burn rate graphs and results tracking convey a sense that everything is under control; and more importantly, the team itself can use all this information to make early mid-course corrections during open enrollment. Reinforcing success and abandoning failure as far as adjusting the marketing mix early can make a huge difference in overall campaign ROI.

Additionally, any marketer that can demonstrate to management that everything is under control, there is more reach available, and there is incremental ROI in applying additional dollars – will often be trusted with more responsibility.

This is true even late in the open enrollment season; if offline channels have been having trouble spending or getting poor results, it’s very easy to reallocate spend to online channels.

Culture is How You Get Things Done; Be Easy to Work With

Company culture, though hard to quantify, involves company values and philosophy, behavioral norms, and unwritten rules of how to get along with others, and is impacted by organizational changes. In our experience with multiple clients, if you take a scale from “collaborative” to “competitive”, health insurance marketing teams tend to skew almost completely on the collaborative end of the scale.

As a result of this, one of the most important qualities when selecting a partner such as a marketing or ad agency is being easy to work with.

What in our opinion constitutes being easy to work with? Well, things like:

- Domain knowledge (so you’re not constantly explaining things).

- Bringing clearly defined roles and processes to the table.

- A commitment to make the client’s job as easy as possible.

- As much transparency through extensive reporting detail as is possible.

- Being open-minded to new ideas, concepts, and ways of working.

For example, if your compliance/legal department has set additional hoops for the team to jump through, it’s not productive to bemoan it; you generally have to roll with it!

So when selecting partners make sure they are both knowledgeable, flexible, and have a very high emotional IQ – particularly if they have to work with others outside the immediate group such as your web team, or in a collaborative fashion with other agencies running campaigns in the same region or channel.

In Conclusion: Stay Up-to-date, Start Early, and Try a Few New Things Each Year

For success, any digital marketing team for health insurance needs to:

- Stay up-to-date on the latest ad formats and policies (let’s face it – this can be a full-time job – this is why partners are important).

- Start development of campaigns as early as possible are key to a smooth open enrollment season.

- In addition to refreshing creatives for new product updates and competitive differentiators, testing new ad formats, channels, or audience targeting this year could be the key for the team’s success next year.